Screening applicants is a stressful and challenging endeavor. You typically only have to screen tenants when you have a vacant home or a home that is about to be vacant.

Screening applicants is a stressful and challenging endeavor. You typically only have to screen tenants when you have a vacant home or a home that is about to be vacant.

A vacant home does not put money in your pocket. Your goal is to find the best possible tenant that you can find as quickly as you can. To do so, you have to cast your net far and wide.

Once you actually start getting applicants, the process can be agonizing. If you make a mistake and pick the wrong tenant, it will cost you money! If you are too hard on an applicant, you could end up losing someone who would be a great tenant!

Written guidelines are a must when screening tenants. Click To TweetHave Written Guidelines

Let’s face it. There is a lot on the line here! Remember, you also must follow Fair Housing Guidelines and not discriminate against anyone.

If you use a property management software and use their tenant screening process, it can be easier. The National Tenant Network will also make recommendations. Heck, they even provide an Adverse Action letter!

Regardless, you need credit criteria for scoring each and every applicant. I would recommend that you have written guidelines as well.

Industry standard requires every applicant to have monthly income that meets or exceeds 3 times the rent. So, if the monthly rent is $1,000, the applicant’s income must be a least $3,000. This is gross income, not net.

Industry standard income requirement for renting a home is income of 3x the rent. Click To TweetIncome Requirements

How do you prove income? Get pay stubs!

You need a minimum of two pay stubs. I require six pay stubs. The applicant income must be provable and must be consistent. If pay stubs cannot be provided, then move on. We live in a digital age and most applicants that have a real job, can easily prove income.

Income That Is Not Stable

You will run across applicants who have seasonal jobs, who work crazy hours during peak seasons, who get tips or who are paid under the table. Keep in mind that the income must be consistently above 3 times the rent every month. It is very hard to qualify anyone who cannot prove that. I would not rent to anyone who has income that is extremely inconsistent.

Job History

We all dream of getting an applicant who has been on the job for 5 or more years. It is still good to find someone who has been on their job 2 or more years. Unfortunately, it is not uncommon to see a job history of 1 to 2 years or even under one year. If someone changes jobs a lot or has changed industries, that will can be disqualifying. However, if the applicant has made a lateral move, or moved up in the same line of work, I will count that. For example, a nurse has skills that can be applied in any nursing job. You will need to ask a lot of questions. It is not always black and white.

Rental History

It is costly to have to rent a house every single year. I do not do anything less than a two year lease. Obviously the tenant can move out early but I charge a break the lease fee equal to one month’s rent in this case. Other companies charge two full month’s rent. An applicant who moves every single year is typically not a good candidate and I would choose someone who was willing to stay longer. You can offer a smaller yearly rental increase if they will stay three or more years.

Eviction History

Evictions or eviction filings are a black mark on any rental history. My rule is that if an applicant has one eviction filing within two years or two or more filings within five years, I will not rent to them. Some landlords will agree to rent with more money up front. You could consider charging the first month, the security deposit and two extra month’s rent, for example. Know the laws in your area! For example, you cannot charge an extra security deposit.

Outstanding Balance To Old Landlord

If an applicant has an outstanding balance owed to a previous landlord , this person is immediately disqualified. I will not ever consider renting to someone who left owing a balance to a landlord. It is non negotiable for me. Once the balance has been paid in full, I will once again consider that applicant.

Credit Score

A credit score is a good indicator of how an applicant pays their bills. It can also be very confusing to look at a credit report. I would use the credit score as only one factor in my decision to rent to an applicant or deny them. There are other factors to consider in conjunction with a credit score. Keep in mind that FHA offers mortgages with credit scores as low as 580 with a 3.5% down payment. FHA also has mortgages with credit scores as low a 500 with 10% down. You don’t want to use criteria that is stricter than what an applicant would need to buy a home.

Collections And Negative Items

Always look at how many bills are in collections and are counted as negative. I don’t count medical bills and student loans. I do look at the other bills this person owes. Basic bills in collections are a red flag for me. My rule of thumb is that if the applicant has 4 to 8 items in collections, I make them pay more rent up front. If the applicant has 9 or more basic bills in collections, I deny them. The applicant must be able to get all local utilities in their name. If they have utilities in collections, that will not be possible. If the applicant can pay them in full, then I will consider that person again.

Pre-Screening Questionnaire

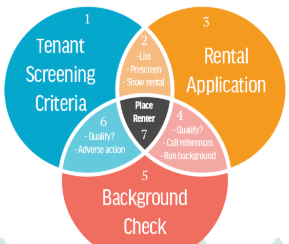

To ensure that you only allow prospects that are pre-qualified to view your homes or submit an application, I recommend that you have a pre-screening questionnaire that you go over with each and every applicant. Again, for Fair Housing reasons, you must do this for every single person who inquires about the house.

A pre-screening form ensures that you ask the same questions of every single applicant. This gives you more information before you spend time trying to qualify applicants who don’t meet your basic qualifications. Applicants can either answer these questions over the phone, come into your office and fill it out or you can email it to them.

Finding A Tenant

Remember that if an applicant had outstanding credit, he or she could just buy a house. The goal is to find the very best tenant that you can with the information you have available to you. A rental application and a credit report are great tools to utilize to find a great tenant.

Success Tips:

- Have written guidelines that you apply to every single application that you receive.

- Have a written question questionnaire that you have every single applicant fill out.

- Require every applicant to have income of at least 3x the rent.

- Require every applicant to provide 6 pay stubs.

- Have written guidelines for situations that you would require additional rent up front.

Following these guidelines will ensure that you stay within the Fair Housing Guidelines. They will also help you select a great tenant for your vacant home.

Need more help? Grab a free Prospect Screen Guide to help you talk to prospects.