Potential Tenant Has Terrible Credit

A potential tenant has terrible credit, but you won’t know unless you actually run the credit of every person that applies to rent your home. This person will do everything in his power to get you to rent to him without running his credit!

As a landlord, I cannot emphasis enough how important it is to run the credit of every single person that applies for one of your rentals because it will help you identify the tenant that has terrible credit. Think of it as like playing Russian Roulette if you don’t run credit checks.

Many potential tenants that you talk to will have bad credit but every so often one will be the worst you have seen to date. The key is to find a tenant with credit challenges that you can live with.

Run Credit Every Single Time!

I just ran the credit of a very nice lady who applied for one of our rental homes. This lady talked openly about her family, her great life and she answered the pre-screen questions correctly. She then scheduled a time to see the home and she fell in love with it.

The home wasn’t much to look at from the outside but was beautiful on the inside. This woman filled out the rental application, handed over $25 and said she couldn’t wait to hear back from me. When I had a minute, I ran her credit and had to wait about 20 minutes as it got sent over for review.

[ctt template=”5″ link=”Wr984″ via=”no” ]Always run credit on prospective tenants! You never know what you will find.[/ctt]

That is usually a sign that there is some issue. Wow! Were there issues!

Pre-Screen All Potential Tenants

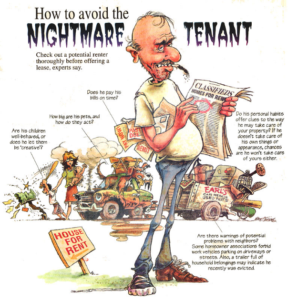

Keep in mind that I pre-screen every single person over the phone before I ever agree to show a rental. Every person is asked:

- Are you employed?

- Where do you work?

- How long have you been there?

- What is your monthly income?

- Where do you live?

- How long have you lived there?

- What is your monthly rent payment?

- How many people are in your family?

- Any pets of any kind?

- Do you have any credit issues? (Evictions filed, collections – especially to utility companies, car repos, any past balances to a previous landlord anything else I should know about.)

This woman was asked all of these questions and more during our conversations. I explain that any of these credit issues will disqualify her from renting a home from us. She was adamant that her credit was great! She had no issues of any kind, had lived in her current house for 6 years and was never late.

Wow!!

Her credit report was far from perfect. In fact, it was one of the worst that I had ever run. She had 3 evictions filed on her just in the last 3 years in the house she lived in for “6 years” and there were evictions that went back 11 years at other properties.

She had a judgement that was 5 years old and was for more than $5,000 owed to a previous apartment complex.

The local utility companies had filed collections against her and somehow the local water company had 2 collections filed against her. I am assuming she didn’t have any utilities on in the house she lived in.

Talk To The Landlord – Don’t Expect The Truth

When I spoke to her current landlord, he was reluctant to tell me anything bad about her and I finally told him what I knew. He just wanted her gone, had scheduled a set out the following week and was not looking forward to getting her out. According to him, the place was destroyed and that the water company had removed the water meter as she was stealing water. He texted me some pictures of the place and they were pretty bad.

[ctt template=”11″ link=”wcdS5″ via=”no” ]Landlords, always talk to current landlords and find out about the tenant.[/ctt]

Her current landlord said she had lived there just over 3 years, not for the 6 years she claimed. He also said that the police were there a lot but he didn’t want to elaborate. The yard was such a mess that code enforcement kept citing the house.

Verify Employment

She listed a place of employment and I decided, what the heck, I was going to call them and see what they said. I was put on hold several times and transferred around and was finally told she no longer worked there.

Needless to say, I wasn’t going to rent to her. I have been lied to a lot over the years and I wasn’t looking forward to calling her. She at first said that wasn’t her and that her identity had been stolen. She begged me to take a chance on her while she was sorting this mess out.

Needless to say, I wasn’t going to rent to her. I have been lied to a lot over the years and I wasn’t looking forward to calling her. She at first said that wasn’t her and that her identity had been stolen. She begged me to take a chance on her while she was sorting this mess out.

Unfortunately for her, I knew that wasn’t correct. The eviction filings were social security verified and I was able to get a copy of the judgement against her. When I explained the information I had and how I got it, she started crying and again asked me to just give her a chance. I listened to her but there was no way I was going to go there.

I’t Ok To Feel Sorry For Them

It’s ok to feel sorry for a potential tenant with terrible credit, just don’t rent to this person. And I did feel really bad for her in one way but given all that I had found out, she had a pattern of behavior that her credit history showed never got any better. This house was really nice and a lot of money had been poured into it to fix it up.

Lesson You Must Learn

The lesson here is that the majority of the people you meet will be nice. They will look nice, be polite and will know exactly what to say to get you to trust them. They may have credit challenges but many times you can work with it.

But desperate people will lie to get what they want and potential tenants that have bad credit will be the worst. This would have ended disastrously if I hadn’t followed our screening policies and asked a lot of questions. I would have ended up with a tenant with terrible credit who couldn’t pay the rent and who I would have had to evict. So, I move on to the next person and hope it works out better.