What Is A Tenant Screening Service?

What Is A Tenant Screening Service?

A tenant screening service is very valuable for landlords. It is a consumer reporting agency that provides information on your applicants life up to this point. It will include information on the applicants credit including a credit score, eviction filings, rental payment history, liens, judgements, employment verification and a lot of other information.

When you have a vacant rental property, you need to find a great new tenant quickly. But quick and great don’t really go together very well. Every time we rent to a new tenant, we are taking a chance on this person. You don’t want to ever make a bad choice. One of the best ways to help assess the risk with every applicant is to take a look at their credit. Past history is usually a very good indicator of future behavior.

Tenant screening services are a great line of defense for every landlord. Without the services of a tenant screening service, it would be impossible to accurately assess your risk level when evaluating an applicant. Unfortunately, many applicants have no idea what their credit looks like and can be completely shocked at what turns up on their credit report. Some applicants are over confident and just assume they have great credit. Other applicants go the other way and just “know” they have bad credit. Sometimes they are right and sometimes they are wrong so it is extremely important to always run a credit report on every single applicant.

Credit Screening Reports

Before you can run credit on an application, you need to find a tenant screening service that you like. They all charge fees and the fees will vary depending on what types of reports you run. Most of these services allow you to pick and choose what reports you want to run. Find a service that you like and use the same credit reporting service every time you run credit. Everyone will look a little different. Credit reports can be very confusing to read and it will be much easier when you pull the same report every time.

Application

Your application is very important. You will need to have a rental application that asks for a lot of detail to collect all of the information that you need to run credit. In order to get an accurate credit report, you will need the applicant’s full name, social security number and date of birth. Keep in mind that a lot of people have the same names out there. The more rental addresses you have from the applicant, the more accurate the report will be. Applicants with common names can sometimes have their credit mixed with someone else who has the same name.

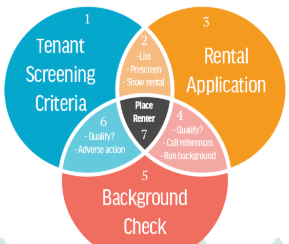

Rental Criteria

When you are reviewing an application and credit report, you must have pre-determined rental criteria to help you decide if this applicant qualifies to rent from you. At the very least, you need to have a credit score requirement, an eviction policy, an income requirement and a job requirement. Without rental criteria, it can be difficult to make the right decision about whether to rent to an applicant or not. It becomes very easy to justify renting to an applicant that you really like personally but how has some credit challenges. Don’t ever try to “force” someone to qualify to rent from you. Your applicant either meets your guidelines or doesn’t.

Make An Informed Decision

Having a tenant screening service will be the different in finding great tenant and terrible tenants. Do not ever skip this step. Most applicants are going to have challenges and your goal is find someone who has challenges that you can live with. A bad tenant can cost you a lot of time, money and aggravation. A credit report gives you the information you need to make an informed and analytical decision. When you do not run credit, you greatly increase the chances that you are going to end up with a bad paying tenant. Why take the risk? The credit report doesn’t cost you anything and there is no reason to not run credit on every single applicant.

Screening applicants is a stressful and challenging endeavor. You typically only have to screen tenants when you have a vacant home or a home that is about to be vacant.

Screening applicants is a stressful and challenging endeavor. You typically only have to screen tenants when you have a vacant home or a home that is about to be vacant.